Keith Harwood, OptionHotline.com

We are going to look at ways to find wins below but I am going to be taking an even deeper dive into these crazy effective filters in a webinar next week on Weds, January 25th at 4:30pm EST. Be sure to sign up here to get access to log in or get the recording.

The wins are there if you stay focused. That’s what my instructors always told me as I learned more about options trading and technical trading. Over time, if you manage your risk right and look for the best odds of success, you will find success. And now, many of those names with the best odds of success are rewarding those willing to take the risk.

Of course, in order to find an explosive setup, I need to know how the market tailwind is setting up, and as has been the case for a while now, my main setup for that is looking at tech stocks.

So, let’s look at QQQ, the NASDAQ 100 ETF, to see how it’s going:

The NASDAQ 100 is testing that area just above the 100-Day Moving Average that has proven to be resistance for months. Could this be our short-term top again, or finally be the moment that the market breaks through and sets up a new resistance level? Time will tell, but for risk management purposes, I certainly like options here to define my risk!

After highlighting KHC 2 weeks ago and seeing it spike up, I wanted to check in on last week’s chart, VRSN:

VeriSign did exactly what I was hoping it would do over the last week. It started to look like a breakout from the range, got a tailwind from the NASDAQ 100, and it took it. These types of moves are exactly why I look at hundreds of charts to find the best setups that I can – leveraging the potential of a technical move with an options setup that makes it a great risk/reward proposal!

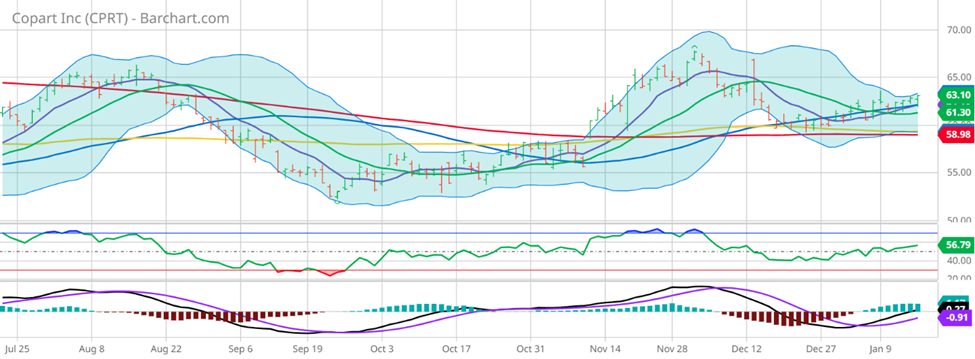

Of course, missing KHC and VRSN doesn’t mean missing out on the overall move. There are plenty of other stocks to follow on the trend in the new year, even if QQQ is testing resistance. For example, let’s look at CPRT:

Copart is testing recent highs, with a key element being that it is above all the moving averages that I watch. Perhaps the upside is to recent highs around $67, and perhaps much more, but if I can even capture that move to $67, that’s more than a 6% upside, and once leveraged with options could easily be 6x or more on that move. That’s a pretty nice return in a short period of time if all goes according to plan.

If you want more of these types of setups, you have to sign up for my Outlier Watchlist. This weekend, I had 29 names on my watch list. If that’s not enough names to find some of the best potential setups in the stock market, while filtering out the trash, I don’t know what is. Keep looking at those KHC’s, VRSN’s, and if all keeps progressing as it has been, those CPRT’s! They’re what can turn a small portfolio into a medium portfolio into a big portfolio in a hurry if you trade them right and the market treats you well!

So please go to http://optionhotline.com to review how I traditionally apply technical signals, volatility analysis, and probability analysis to my options trades. As always, if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments