Dear Reader,

This morning, I was scanning the market and came across this beaten down stock chart, did you happen to catch it too? If not, don’t worry, I have a full breakdown below.

The trade I spotted earlier is for Lam Research Corp. symbol: (LRCX).

What made LRCX stock standout is what I noticed in its stock chart. After pulling up LRCX’s chart I noticed that the stock is signaling a powerful ‘Sell’ signal!

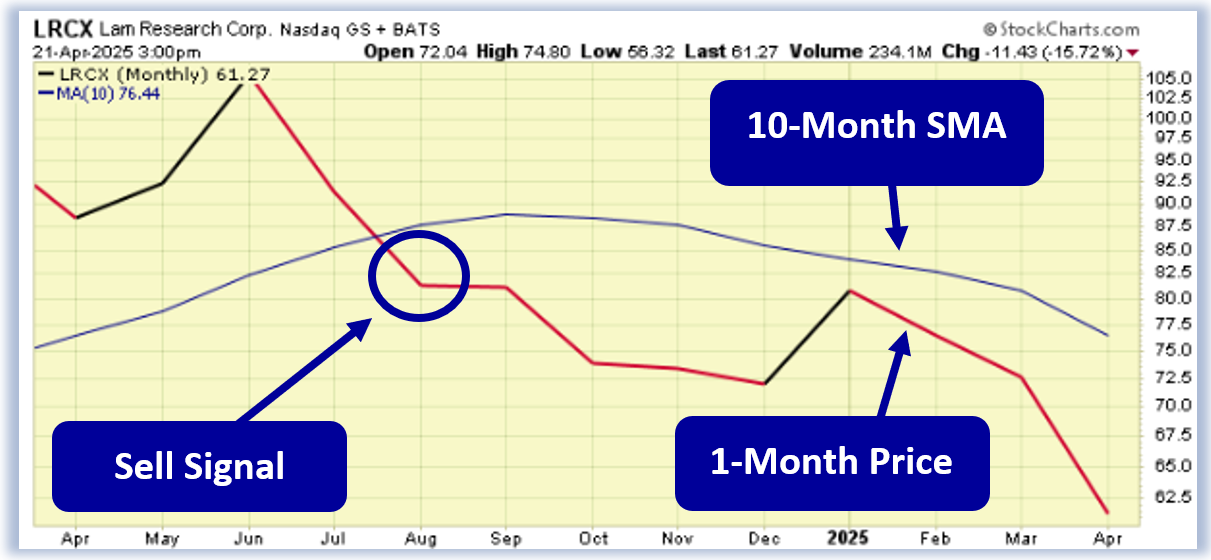

Below is a snapshot of LRCX’s current stock chart. Let’s dive in so I can show you what made me stop scrolling when I saw this chart.

Attention Investors and Traders! Curious about Chuck Hughes? Discover the secrets behind 23 profitable years in a row. Get this Ebook now to get started!

When I looked at this chart, I saw that back in August ‘24, LRCX shares experienced a bearish tumble to the downside which generated a brand new technical signal for the stock.

In August ‘24 LRCX’s 1-Month Price finished the month trading below the 10-Month SMA and following my PowerTrend system, this qualifies as a ‘Sell’ signal for the stock.

Now, you may ask yourself, “Well the sell signal occurred in August ‘24, have I missed the chance to trade this?” Don’t worry because we still have an opportunity to take advantage of this stock’s move, and I’ll tell you why.

This crossover indicated the selling pressure for LRCX stock exceeded the buying pressure. For this kind of crossover to occur, a stock has to be in a strong bearish downtrend and as you can see, the 1-Month Price is still below the 10-Month SMA. That means the bearish trend is still in play!

When stocks breakdown to the downside like this, the bearish trend can often last longer than one might think.

How I Would Look to Trade It

Since LRCX’s 1-Month Price is still trading below the 10-Month SMA signaling the PowerTrend ‘Sell’, this is offering an attractive trading setup.

I want to look to trade LRCX’s trend and have the opportunity to capture some profits by placing an options trade on the stock.

Below is a Put Option Debit spread for LRCX that I found just this morning that would allow me to gain some exposure to the stock’s significant bearish trend but also have some upside protection built in as well. Let me tell you how this works.

Once I place a Put Option Debit spread, it has the ability to profit if the underlying stock/ETF is either down, flat, or even up a bit at option expiration.

Below is a snapshot of my Put Option Debit Spread Calculator that shows the profit potential and downside protection analysis for my trade. This example examines a range of a 10.0% decrease to a 10.0% increase in LRCX share price at option expiration.

Looking at the trade analysis, the calculator shows that this one single trade, that would cost you only $330 to enter, has the ability to profit 51.5%.

The calculator reveals that if LRCX, at option expiration, were to decrease, remain flat, or even increase by as much as 10.0%, this low-cost trade would be set up to make a 51.5% return!

This Put Option Debit Spread strategy has been one of my absolute favorites to trade over the years and remains so today. The key behind it all is that by enabling your ability to profit if a stock is down, flat, or even up a bit gives you a much higher probability that your trade will end up a winner.

The Hughes Optioneering Team is here to help you identify high-probability trades just like this one.

Interested in accessing the Optioneering Calculators? Join one of Chuck’s Trading Services for unlimited access! The Optioneering Team has option calculators for six different option strategies that allow you to calculate the profit potential for an option trade before you take the trade.

Chuck’s Lightning Trade Alerts!

Chuck Hughes is offering YOU an opportunity to join his exciting trading service program, Lightning Trade Alerts. This service focuses on low-cost & short-term options trades.

Members will receive hand-picked trades from the 10-Time Trading Champion, Chuck Hughes.

Please give my team a call at 1-866-661-5664 OR ‘Click the button’ below to schedule a call and get started today!

Wishing You the Best in Investing Success,

Chuck Hughes

Editor, Trade of the Day

Have any questions? Email us at dailytrade@chuckstod.com

*Trading incurs risk and some people lose money trading.

Recent Comments