From Keith Harwood, OptionHotline.com

The market finally panicked. And it may panic some more. Or it may stop panicking. Or will it panic more? Even thinking about this is enough to trigger a panic attack.

And yet, this is probably a better opportunity to take a few deep breaths and look for opportunity. After all, the S&P 500 has had an 8.4% range over the last 5 trading days while the NASDAQ 100 has had a 10.8% range. If you were to go back to 1957, you can see that the S&P 500 has averaged around a 10.7% return annually. So…there’s been about a year’s worth of movement in the last week…there’s a bit of volatility, I suppose…

And it’s probably well-deserved! We have COVID spike fears, interest rate hike fears (with an FOMC decision later today), major inflation, Russia/Ukraine, and a myriad of other issues such that I’m just going to stop trying to list them. And now that the market has had major corrections in valuation levels, I’m thinking it’s time to ignore all of that and look for stocks and sectors to buy!

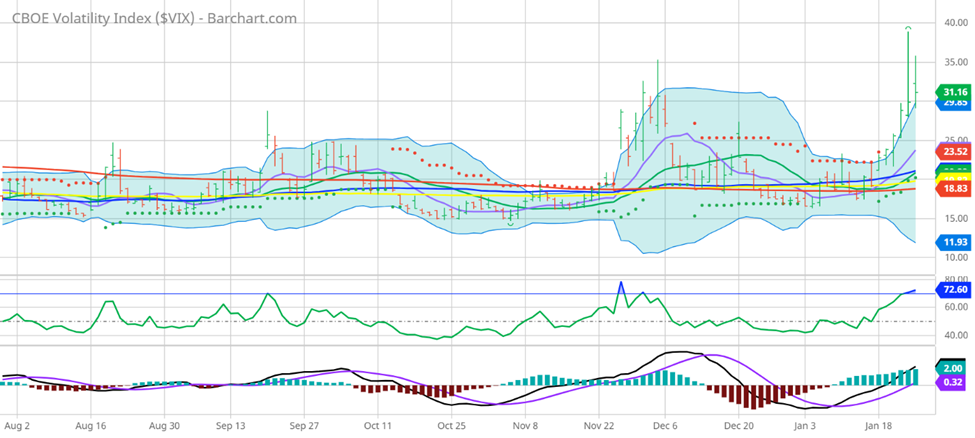

Now, maybe I’m a little bit crazy. Or maybe I’m a lot bit crazy. But, for me, this seems like a time where the VIX is telling the whole story of peak panic…at least for now…

When I look at this VIX chart, I see a major spike on Monday as we reached lows. The end of the bull market was here and this was set to be the biggest VIX spike since…well…November. This VIX move was NOTHING like what we have seen in years past, but that also tells us a lot about the level of panic. The market was simply able to handle the selling and the volatility spike better than in it did in more major economic crises. And perhaps that’s because we aren’t really in a major economic crisis. Needless to say, we need to stay below Monday’s high in the VIX to keep me excited about the bounce back in equities.

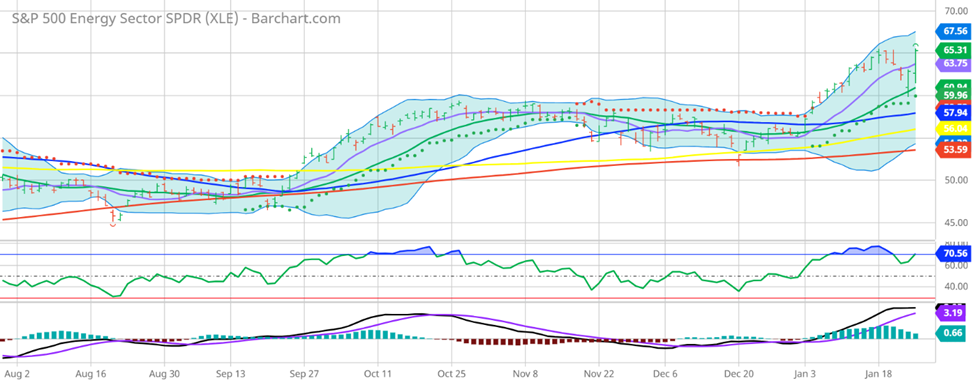

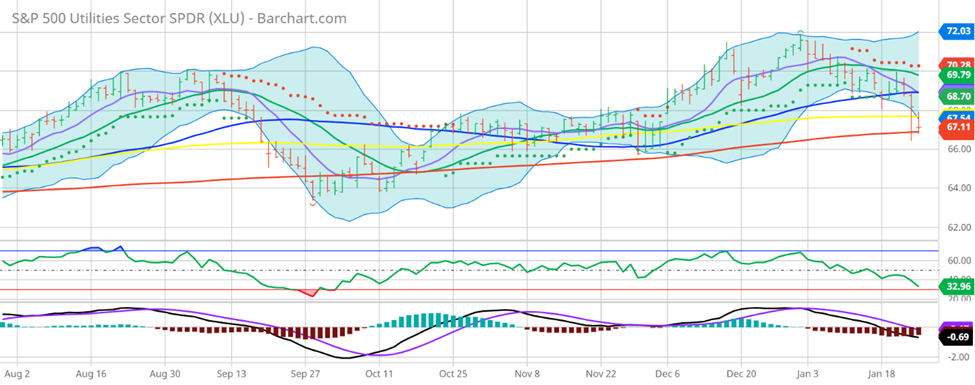

While I didn’t want to buy on Monday’s lows, I am tempted to buy today as long as the market stays above Tuesday’s lows and the VIX stays below Monday’s highs. And where I may be most tempted is in those sectors that simply have less reason to go down: energies and utilities.

As you can see, both of these sectors have stayed well above long-term moving averages and continue to show strength. However, they differ in their recent structure: Energies are near highs while Utilities are trying to prove that the 200-Day Moving Average will provide support.

Now, while they may not provide the same leveraged returns as other sectors if we simply put all stocks back to their levels from 1 month ago, they can actually provide similar leverage if we use options to execute that trade idea. It’s all about finding the right options trade at the right time to generate a leveraged return.

So, please go to https://optionhotline.com to review how I traditionally apply technical signals and probability analysis to my options trades. As always, if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments