Keith Harwood, OptionHotline.com

What a market! We have had some wild whiplash going on over the Silicon Valley Bank (and other) failures. And in the process, I’m starting to see what I love to see when markets go crazy: I am starting to see opportunity! And I’m focusing on the opportunity that I see in my Outlier Watch List!

When the bank failure was announced on Friday, the opportunity was frankly not clear, but I created a list of sectors I wanted to focus on, and a list of about 35 stocks that I thought could be of interest via my Outlier Watch List. That’s just the type of homework that professional traders do to prepare for every week and every day of trading. So, while I saw that markets were collapsing, but the fundamentals supported it, I also knew that I need to be ready for what could happen if the fundamentals changed.

Then, on Sunday afternoon, the news came out that the deposits at Silicon Valley Bank would be backstopped. That alone stopped many tech companies and regional banks from going under. And in the process, it set up a major potential recovery for the market. Many stocks on my watchlist recovered while others are still trying to find their footing. This is a situation where you really need to dig in and look at all the charts to decide which stocks deserve to recover on your watchlist. That’s what I’m doing right now!

Regional Banks (represented by the ETF with symbol KRE) are still quite a bit weaker because this was a bank issue, so it makes sense:

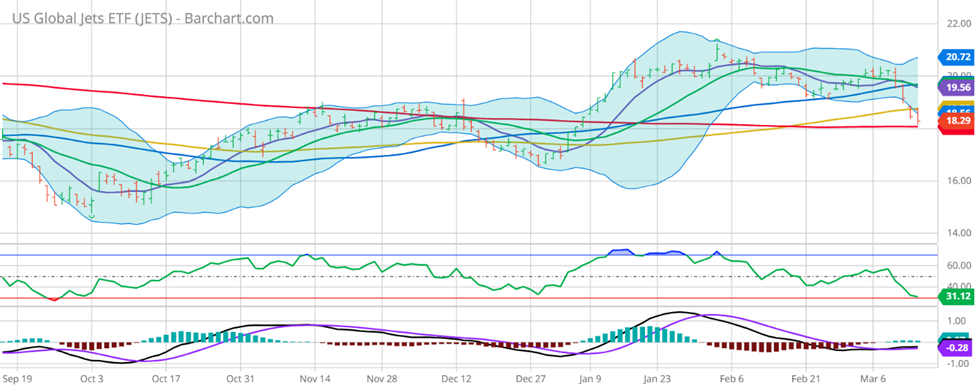

And other sectors are weak, too. But should they be? Let’s look at JETS (an airline ETF):

Should airlines be weak off of regional bank failures and lower oil prices? Is travel getting harmed by higher interest rates that no longer seem to be getting priced into the market and may not occur as a result of what happened at Silicon Valley Bank? And if all this means there’s an opportunity to buy an airline company, which one?

Well, in my Outlier Watch List, I have been highlighting United Airlines recently – stock symbol UAL. Let’s take a look at it:

As you can see, UAL is actually not looking all that bad relative to the market pullback, and yet, it did pull back due to this recent unrelated scare. And while JETS and other airlines are testing the 200-Day Moving Average, UAL is still holding above the 100-Day Moving Average. That’s opportunity!

So please go to http://optionhotline.com to review how I traditionally apply technical signals, volatility analysis, and probability analysis to my options trades. As always, if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments