Friday, October 1st, 2021

Happy Fabulous Friday!

I teach everyday people (like me) to trade options. I do my best to write in an understandable way as if we are talking over the kitchen table.

The market volatility continues. Tuesday this week there was another sizeable drop after the market worked to recover from last week’s pullback. It only gained about half of the drop and now is down again and trying to head back up. The bias is still likely to be to the downside for a while longer with more back and forth movement. This means we need to look for equities that have strong moves in one direction or the other.

For today’s Trade of the Day, we will be studying Netflix, Inc. (NFLX) which is benefiting from families spending more time at home.

Netflix, Inc. provides entertainment services. It offers TV series, documentaries, and feature films across various genres and languages. The company provides members the ability to receive streaming content through a host of Internet-connected devices, including TVs, digital video players, television set-top boxes, and mobile devices. It also provides DVDs-by-mail membership services.

The company has approximately 204 million paid members in 190 countries. Netflix, Inc. was founded in 1997 and is headquartered in Los Gatos, California.

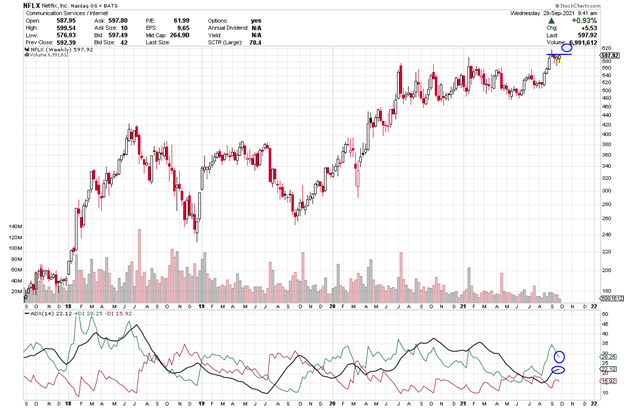

Let’s take a look at NFLX’s weekly chart.

The ADX +DI (green line) is above the -DI and if it keeps heading up, the ADX line will continue to turn up. As long as the +DI is above the -DI, price should rise. Green above red is an indication of strength. When the +DI is bullish and the ADX turns up, it shows strength. If you want to learn more about ADX, read on or, if not, scroll down to the alert.

Average Direction Index (ADX) – Strength Indicator

The Average Directional Index consists of 3 lines: Green, Red and Black.

Green = +DI (Bullish)

Red = -DI (Bearish)

Black = ADX Strength Line

The DI line that is on top is in control. If the ADX line is heading up, strength is supporting the DI line that is on top and in control.

Check Out the Trade Alert Signal

Each candle on the chart represents price movement over a 5-day (week) period; therefore, it takes weeks for trades to play out. On the chart, the week is a bullish candle as I type. When the +DI crosses over the -DI line, it gives a buy signal (as the +DI line (green) appears as if it is in control and rising to head up on the ADX indicator, and as the ADX turns up that is even more bullish, suggesting an upward move is gaining strength. I’d like to see the green line to continue its upward bias and then the black line to turn straight up and head up as well. All are bullish signs of strength. When the +DI crosses the ADX (black line) and when it rises, it shows a new burst of strength coming into the equity.

The Black ADX line is a strength line and if it flips up and continues to head up, it shows strength, and we’ll know strength will continue to flow into this equity. We will keep an eye on NFLX over the course of the next few weeks.

If NFLX’s price moves above or stays above $600, you could consider a trade. The short-term price target for NFLX is $620 and then, perhaps, higher. With the swings and recent volatility, I am suggesting small profit targets until a market trend starts again.

NFLX is a pricier equity and trading it will not be appropriate for every trading account, but it is still a great equity to study to learn about the benefits of option trading.

NFLX Potential Trade – Showing Strength

This signal could give a quick payout if it continues its upward move, and the 6strength of this pattern continues. It looks as if it could push above $600. I am typing on Wednesday and NFLX started the day at $596 but is heading up, if it moves above 600 showing it is breaking above being flat, a trade could be considered.

To buy shares of NFLX would cost approximately $600 per share and if it reaches its near-term target of $620 that would be a gain of $20 or 3%.

This is a great example of the benefits of trading options. Let’s discuss this as a study case.

Option trading offers the potential of a lower initial investment and higher percentage gain. Let’s take a look and make a comparison.

The plus DI (green line) is above the -DI and if it stays above the -DI (red) line and rises above $00 by Friday a call trade can be considered.

If you buy 3 shares at $600, you will invest $1,800. If the stock increases in price to $620, you will earn a profit of $20 per share or $60 for the 3 share or about 3%.

If you bought one option contract covering 100 shares of NFLX with an Oct 22nd (Oct wk4) expiration date for the $620 strike and premium would be approximately $16.20 today or $1,620 per 100 share contract. If price increased to the expected $620 target or a gain of $20 over the next few weeks, the premium would likely increase $10 to $26.20 ($10 x 100 share contract = $1,000 Profit.) $1,000 profit on your $1,620 investment, this is an 62% gain. Nice! Terrific trade if it hits it target!

Trading options is a win, win, win opportunity. Options often offer a smaller overall investment, covering more shares of stock and potential for greater profits.

I like to stress when trading options, you don’t need to wait for the expiration date to close the trade. You can close anywhere along the way prior to the expiration date. It is never a bad idea to take profit.

Trading options is like renting stocks for a fixed period of time. The potential to generate steady income with options is real and it can be transforming. Watch this video to learn how you can use option trading to achieve financial freedom. click here

Yours for a Prosperous Future,

Wendy Kirkland

PS-These letters are a glimpse at what I am watching in the markets. It is important to do your own research and make sure you understand the techniques I am discussing and are comfortable before placing any trades. To learn more about how I find these trades and determine the optimal position to take, click here.

Past Equity Candidates:

Two weeks ago, we looked at TECK and a Oct 15th (Oct 21) expiration, a 28 strike and a premium of .98. Last as hit with the big drop. Price is back up to 25.26 on Wednesday as I type and its premium has dropped further in the recent swings to .31. It still has time if traders didn’t close as the market plunged. Time decay is starting to escalate. It needs some big moves up and it is getting harder for that to happen when time decay is considered.

Last week, we discussed AXP with an October 8th (Oct wk 2) 175 strike call at a premium of 1.31. It rose as high as 178.50 on Monday this week and its premium went as high as $4.95. Great gain for one day and then with Tuesday’s pullback it has declined to about the entry premium of 1.30.

Recent Comments