From Keith Harwood, Optionhotline.com

Today is Fed day. The FOMC meeting will be after the close, and I’m trying to get a sense of what in the markets can indicate the next great opportunity.

Given the liquidation we have had since the Russian invasion of Ukraine, I’d really like to find a signal that the markets have found a bottom. But, when I look at the chart of SPY (the S&P 500 ETF), it seems like we may still be waiting on confirmation:

As you can see, we are barely above the 10-day moving average, which is bullish, but still below all other moving averages that I look at. So, from that perspective, it seems that maybe Monday was possibly the bottom, but the market is still tough to buy without more confirmation.

There are 2 more signals that I can see indicating that maybe we are at a bottom, and if so, today we should see that repeated close above the short-term moving averages to confirm a bigger bounce.

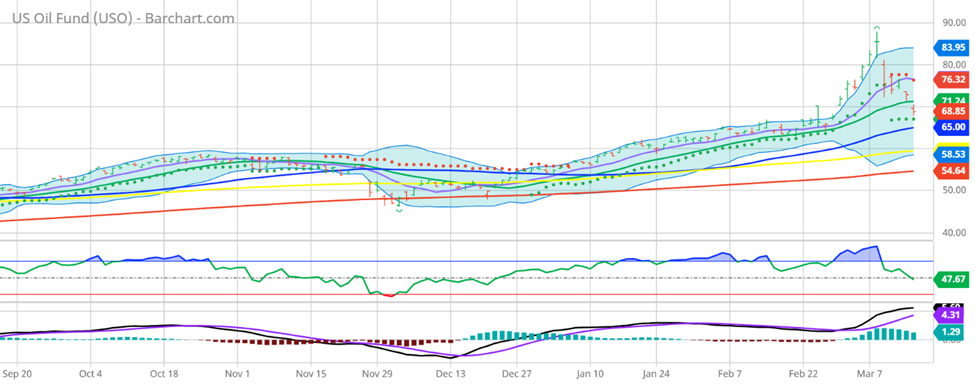

First, I’ll look at oil since it has had a MAJOR spike off Russian tensions. And yet, yesterday’s close puts oil right back into the end-of-February levels, where tensions with Russia and Ukraine after the initial invasion on February 24th. Let’s look at USO (the US oil ETF):

It seems like the market is pricing in the idea that these tensions will dissipate and that would be bullish for global stocks.

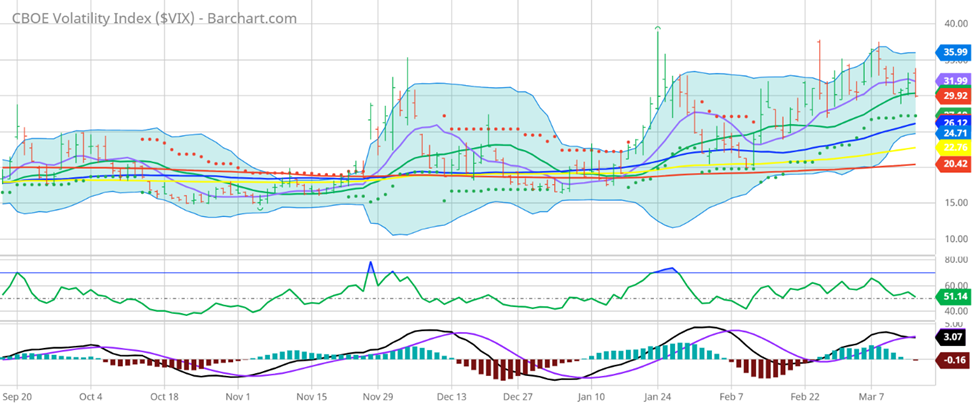

Finally, with all of this in mind, I want true confirmation that the market isn’t all that worried anymore. The best way to see fear is to check out the VIX – the volatility index on the S&P 500, which is commonly referred to as the fear index:

We finally see a close below both the 10-day moving average and the 20-day moving average – we haven’t seen a close below both since February 9th, about 2 weeks before Russia invaded. Those short-term signals tell me that people think that the fear is priced into this market and maybe the downside isn’t really that concerning anymore.

But to trade that, I still want to see another close in the S&P 500 or NASDAQ 100 above the 10-day moving average. It can certainly be a false bottom, which is why I want defined risk. And it could be the start of a bigger recovery, which is why I want leverage. And I can get both using options, particularly if the VIX continues to fall.

So, please go to https://optionhotline.com to review how I traditionally apply technical signals and probability analysis to my options trades. As always, if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

PS-Be sure to grab my Outlier Roadmap here to spot the best options trades Wall Street doesn’t want you to see. Get it here.

Recent Comments