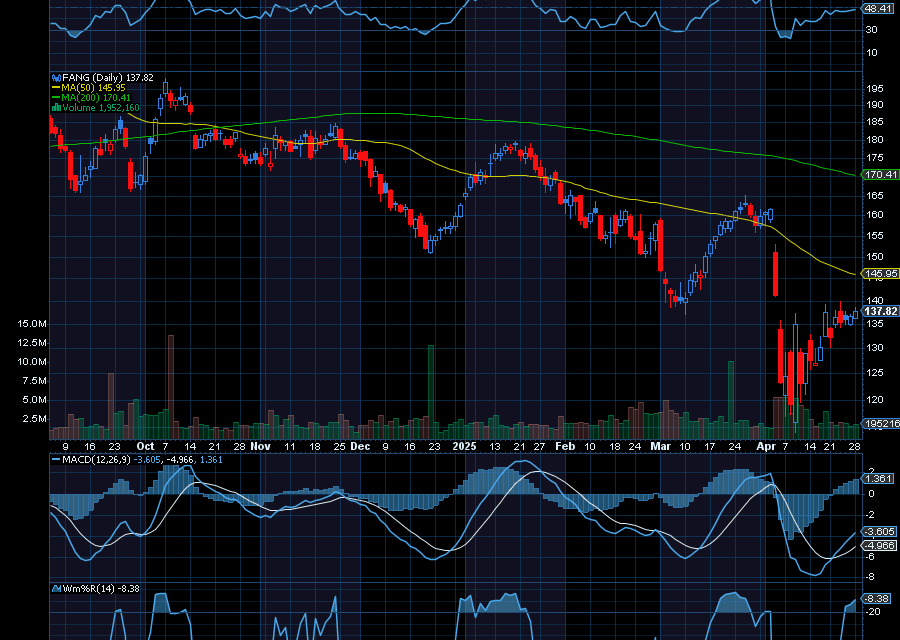

Keep an eye on oversold, but rebounding shares of Diamondback Energy (FANG). After dropping from about $165 to a low of $114, FANG is now back up to $137.82. From here, we’d like to see it initially refill its bearish gap at around $165. Fueling upside, analysts at Bank of America just said FANG is one of its top oil picks, giving it a buy rating and a new price target of $170. “Within the largest and most liquid caps in our coverage universe, we believe that Diamondback offers the best combination of value and defense,” said the firm, as quoted by CNBC.

Analysts at Citi upgraded FANG to a buy rating with a price target of $180, noting that FANG’s pullback presents us with an opportunity to buy a high-quality E&P stock. Making it even more attractive, FANG yields 4.72%. So, while we wait for the stock to appreciate, we can at least collect the yield. It last paid out a $1 per share quarterly dividend on March 13 to shareholders of record as of March 6.

Sincerely,

Ian Cooper

Recent Comments