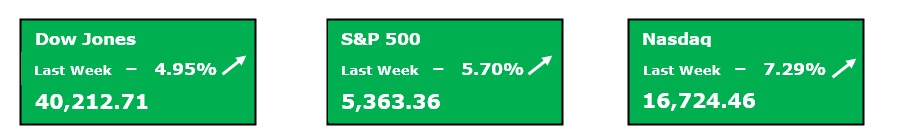

Headed into the past week, anxiety was running high for investors as we were on the tail end of ‘Liberation Day’ which resulted in markets completely breaking down on Thursday & Friday, headed into the weekend. Over the weekend, market watchers were on edge hoping for a headline that the President would offer a ‘carrot’ to investors signaling some pause or reprieve from the massive ‘Reciprocal Tariffs’ that had just been announced. As we got into the evening hours of Sunday, it became clear no such gift was coming from Washington before trading opened for the week and this was reflected in the Futures markets which began to imply a very ugly open on Monday for equities. This materialized as the S&P 500 opened about 2.5% lower to begin the week and this was only the beginning of what would become a week featuring near-unprecedented volatility yet would ultimately end with major indexes substantially in the green for the week. The past week featured multiple $VIX spikes above 50, indicating severe volatility in addition to multiple days where the S&P 500 index traded within an 8.5%+ range intra-day. While this substantial level of volatile trading was not over, it peaked out during trading hours on Wednesday after a surprise announcement from President Trump which paused ‘Reciprocal Tariffs’ for 90 Days for all trading partners except China. After this announcement began to circulate, markets experienced one of their largest single day rallies of all time. This was a substantial development for investors as it relieved some immediate pressure, allowing a chance for true trade negotiations to occur before the steep draconian tariffs were put into place. The market’s view is largely that while we are certainly not out of the woods yet, especially on the China front, this development was an important sign of progress in resolving this issue.

After this past week’s massive swings in the market, we need to take stock of where things currently stand. Despite some of the historic single day moves higher that we witnessed this past week, if history is indeed any indication, what we will see is that a large number of these types of moves that have previously occurred did so in the context of a bear market and were not a sign of the bottom or a complete trend reversal. Of course, no one can predict the future, however, in our experience history and the future often rhyme and there is an important lesson to be learned here. So, while we certainly will take the major move to the upside, we understand that this likely will prove out to not be a trend reversal. Looking to the market internals, I think helps to solidify that this past week’s recovery was likely a typical ‘bear market bounce’ where the broader markets whipsaw higher in the context of a longer term downtrend. If you look at the NYSE Advance Decline index, this shows the index made a new lower low and lower high this past week, a sign of weak market breadth. Furthermore, despite the S&P 500 index ending the week up nearly 6.0%, still 57% of the index’s constituents are 20% or more below their 52-week high. Each of these internals are strong indicators of continued broad weakness in stocks.

Now that this past week’s trading is in the books, as of the close on Friday, the S&P 500 is down 8.8% YTD and nearly 13% below the highs. This of course is well off of the lows we touched on Monday, and there were some positive technical signs with the index closing above several significant support levels. These were certainly good indications, however, given the state of the market internals, even though the index is not in a ‘technical bear market’ (20% decline), it is our opinion that is still where the market currently finds itself. After the massive bear market bounce experienced last week, we anticipate that in the coming weeks we are likely to retest the early week lows unless there are further major developments on the trade policy front and quickly. With us headed into the true meat of earnings season, it is difficult to assume that we are in for some form of V-shaped recovery given the murkiness surrounding the results that companies are set to report in the weeks to come. As we are going through a period of P/E multiple compression, until we get some clarity on the earnings side of things, we cannot comfortably say that the bottom is in for the indexes quite yet and that more likely we are in for some form of W-shaped recovery over time. While we wait for clarity, we are continuing to be judicious in picking our spots in the market as we anticipate the current volatility to persist at least for the short term.

🚨 Have you heard about my WPO Newsletter, that recently gave my members the chance at a 148.9% profit opportunity? Go ahead and Click Here to begin your trial for JUST $1 Today! 🚨

Key Events to Watch For

- Trade Deal Developments (Tariff Removals)

- U.S Retail Sales (March)

- Q1 Earnings Ramp Up

As we head into the coming weeks, one thing all investors need to be on watch for are any developments regarding newly negotiated trade deals. It is clear right now that U.S. trade policy developments are driving this market. As the vast majority of the ‘Reciprocal Tariffs’ have been delayed for 90 days, we know the Administration is actively involved in various negotiations with numerous trade partners attempting to iron out new trade deals. This of course is no guarantee that a new deal will be reached with these partners. However, any positive developments on this front signaling the removal of tariffs, particularly with our most impactful trade partners, will likely be met with strong optimism from investors. Regardless of one’s personal feelings about the President, it is a clear personality trait of his, that he likes to cut fresh deals where he can be viewed as coming out as the ‘winner’. Due to this, it would be prudent to anticipate some of these announcements in the coming weeks. The market impact of such announcements will be highly dependent on the terms of the agreement itself, and with which partner the deal is made.

In the past week, ongoing concerns regarding the strength of the U.S. consumer and their willingness to continue spending were only magnified as trade tensions between the U.S. and trading partners, principally China, continued to heat up. Additionally, this was reflected in fresh soft data like consumer sentiment, which continued to wash out, casting further doubt on the trajectory of domestic consumption. This week, we will get a fresh hard datapoint that will help to paint a clearer picture here. On Wednesday, the U.S. Retail Sales report for March will be published and this will indicate what U.S. consumers actually did with their dollars in the month. Now, recent prints have been disappointing as actual Retail Sales have missed expectations since the December report, including one month when a negative figure was posted. Expectations are that March Retail Sales will have grown 1.3% MoM. Some speculate that many consumers pulled forward some large purchases in March in anticipation of incoming tariffs and higher prices. Regardless, Wall St. will be pleased if we get an acceleration in consumer spending, reversing the current trend.

Finally, the remaining events in the coming week that deserve investor’s attention are the Q1 earnings announcements slated for this week. Q1 earnings season will really begin to ramp up this week as we will hear from a wide range of significant multinational Large-Cap companies. One theme we fully expect to play out this earnings season is mass-retraction or pulling of forward guidance. In the current environment, there is still so little visibility on the horizon for businesses until new trade deals, whatever they may be, are finally ironed out and the rules of the road are made clear. With that said, this week a number of major U.S. Financials are on deck to report earnings, including Goldman Sachs Group, Inc., Bank of America Corp., & Citigroup, Inc. amongst others. A few other companies of note that are set to report Q1 earnings results this week are UnitedHealth Group, Inc., Taiwan Semiconductor Mfg. Co., & Netflix, Inc.

Thank you for reading this week’s edition of the Weekly Market Periscope Newsletter, I hope you enjoyed it. Please lookout out for the next edition of the newsletter as we will give you a preview of the upcoming week’s important market events.

Thanks,

Blane Markham

Author, Weekly Market Periscope

Hughes Optioneering Team

Recent Comments