The market is searching for answers after a weak run for the past 4 days. But, there are diamonds in the rough that are starting to shine through, and those are the opportunities that I am focusing in on.

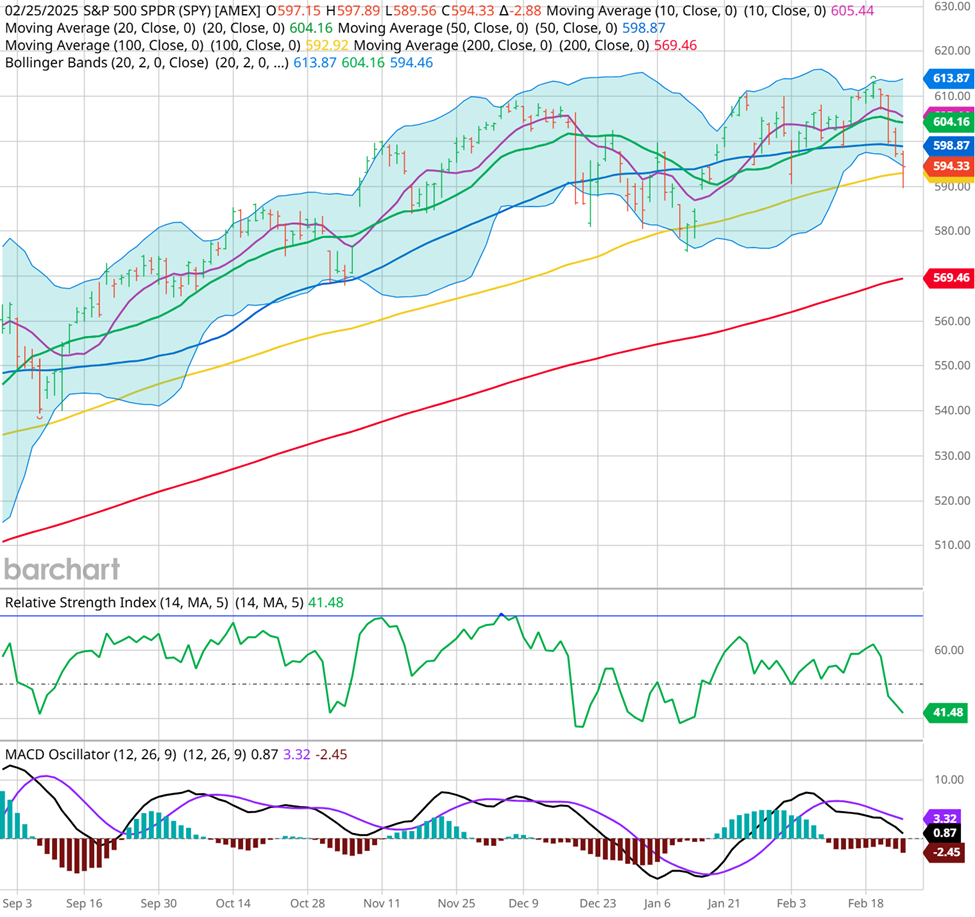

Clearly, the broad market is in risk-off mode as we see the S&P 500 fall aggressively:

With concerns over the economic growth forecast, investors and traders appear to broadly be going to the sidelines. Some of this has been attributed to Palantir, and some to poor earnings from Walmart being a sign of a weakening economy, but from my view, there are a number of economic inputs that have been somewhat ignored recently as signs of a slowdown. Whatever the ultimate cause is determined to be, the market is aware of the potential for downside, and as a result, people are selling.

But not everything. And while I’m intrigued by ideas like IAK (an insurance company ETF), my interest is piqued by the behavior of Walmart itself on Tuesday:

WMT is showing signs of bottoming with a very solid recovery on Tuesday. It may not be bullish, but it could be an early indication of an overdone selling situation given the attribution to WMT earnings as a trigger for the market’s fall.

So, where’s the opportunity? Perhaps a related name in the discount retail space is the ultimate play here, and so I’m looking at Dollar General:

DG has been very weak, don’t get me wrong. But some of the best plays coming out of market liquidation can be to find weak names that are getting buyers. It’s not because they’re not bearish in the long haul, but if risk-off already happened from the long side, the next logical move for many money managers is to clean up the short positions on their books and look to re-evaluate fundamental valuations for new positions after managing risk. That means buying the weakest stocks out there that simply stopped going down.

The other good news for DG is that it’s breaking out of the recent range. It’s finally closing above the 100-Day Moving Average, something that it hasn’t done since May of 2024. And it has earnings in about 2 weeks, so we may see more position clean-up prior to that earnings announcement. Of course, it may simply fall back down as money flows right back into the traditionally favored tech growth names, but this could catch a volatile upside move during a market recovery that I cannot ignore.

When I see a possibility of volatility in the short-term, I certainly tend toward looking for a leveraged tool, and that’s what options are. So, for a short-term move with a short-term hold, DG call options look like an attractive trading opportunity. Oh, and did I mention that it also happens to be a stock that hit my AI screeners for potential upside in the coming weeks?

If you want to learn more about utilizing AI for predicting dynamic markets and the incredible opportunities that can be captured utilizing state-of-the-art technological advancements in trade recognition, send me an e-mail and I’ll be sure to get you all the information you need!

As always, please go to http://optionhotline.com to review how I traditionally apply artificial intelligence, technical signals, volatility analysis, and probability analysis to my options trades. And if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments