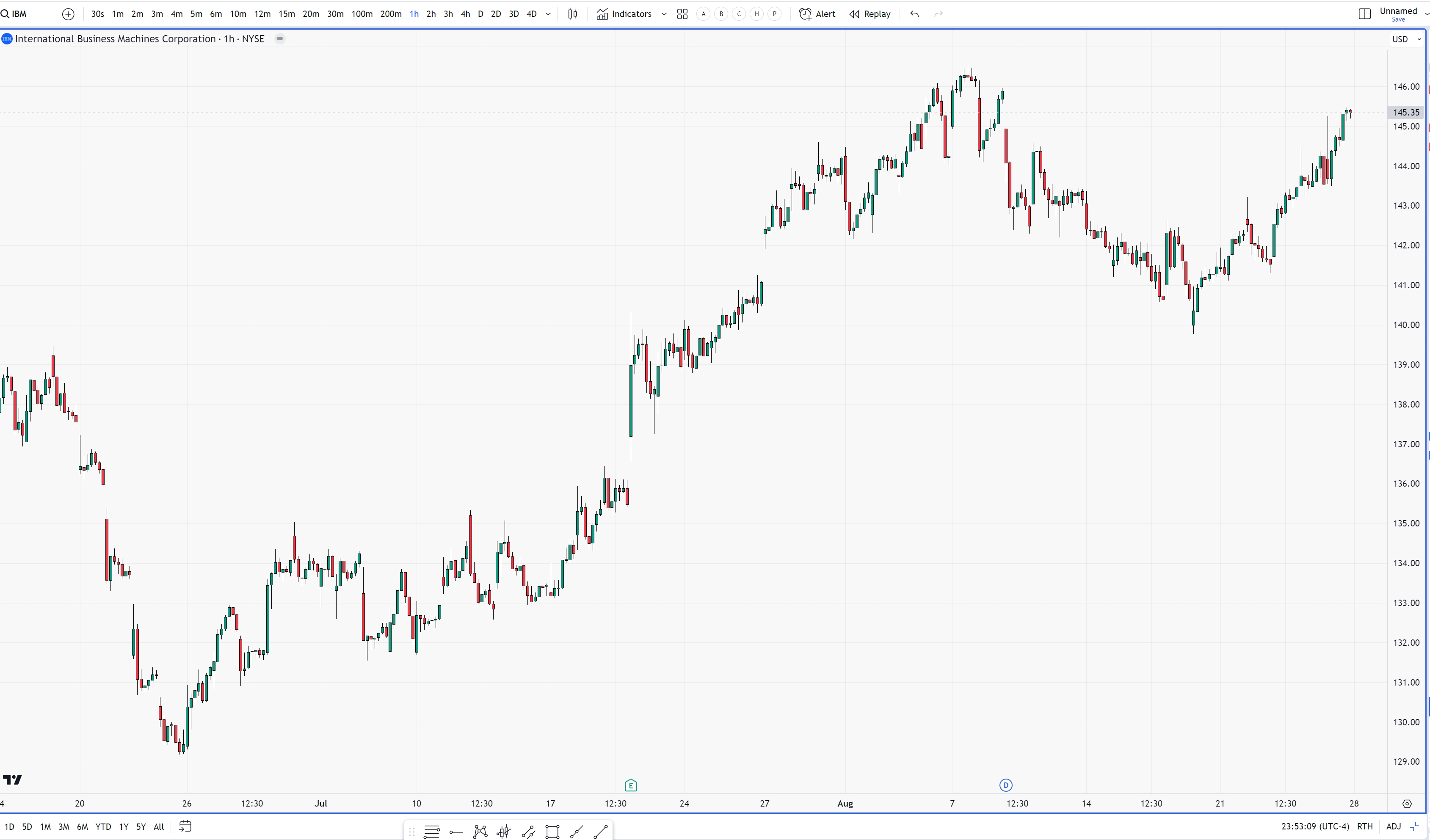

Long positions purchased last Wednesday in IBM are showing gains as per attached hourly chart. Those longs purchased in AMD are not, but I continue to believe that will happen. Last week, I thought the trap was set Tuesday and sprung Wednesday. I amend that view only slightly to allow that the market reset a bigger trap on Thursday. The market has become too bearish in the face of relatively little decline, as pointed out last week. The leading stocks are still within easy distance of new swing highs. I expect continued strength in the coming week.

The market got a bearish Powell in Jackson Hole on Friday. It held the lows and rallied anyway. It’s compelling that right now the market doesn’t care. Yes, the macroeconomic fundamentals are horrible on many fronts. If the last couple years have taught us anything, it is that macro economics doesn’t matter until it does. Eventually it will matter, and I think the decline of the last three week was a minor shot of warning. However the market participants are still in my view much too willing to embrace the bearish view. We need a very strong advance with strong up days to not only vanquish the bears’ positions, but to make them too scared to short again. And in my opinion that is what is about to unfold. If I am correct the real downside damage will occur after that. I do not believe it will happen from here.

This week I will look to add to longs as long as the lows hold on a daily closing basis. I like JPM, UBER, AMZN, GOOG, DKNG. Look for chip stocks Nvidia and Advanced Micro Devices to be bid as well. If the chip stocks aren’t going to rally neither is the market, so given they have sold off it’s a good place to look for buy opportunities. By the same logic, I have to favor AAPL, because if the market is going to rally, so is AAPL.

In conclusion, if last week’s lows hold on a closing basis, look for a rally that at some point before it is over, will accelerate sharply to the upside. I wouldn’t be short here.

Thanks.

Joe

Recent Comments