From Keith Harwood, OptionHotline.com

We have an interesting mix of signals going on in the market.

The first main indicator that I’m looking at is bonds. Let’s take a look at TLT, which is and ETF that represents US Treasury Bonds:

Bonds have started to resume their downtrend but are yet to break the prior low. In fact, there’s quite a bit of room left before I can call this a truly concerning move. This could simply be a pullback before a resumption in the recovery. What’s crucial to know, though, is that when Bonds fall, it’s an indication of interest rates rising, which tends to be bad for stocks. Higher yield in lower risk assets like bonds means there’s less reason to take reason in the stock market. So, we should be expecting a fall from recent highs in stocks, particularly tech which tend to be highly correlated to bonds. But we shouldn’t be testing lows quite yet.

To see if the market agrees, let’s look at the chart of QQQ, the NASDAQ 100 ETF:

QQQ is agreeing while simultaneously disagreeing. They fell but fell much closer to recent lows. Perhaps it’s time to wonder if the stock market has gone too far. Or perhaps the stock market didn’t go far enough last time it fell. To add another interesting twist, I’m seeing a lot of individual names in tech that are showing signs of a bullish trend but just getting a pullback, which I outline in my Outlier Watch List each week.

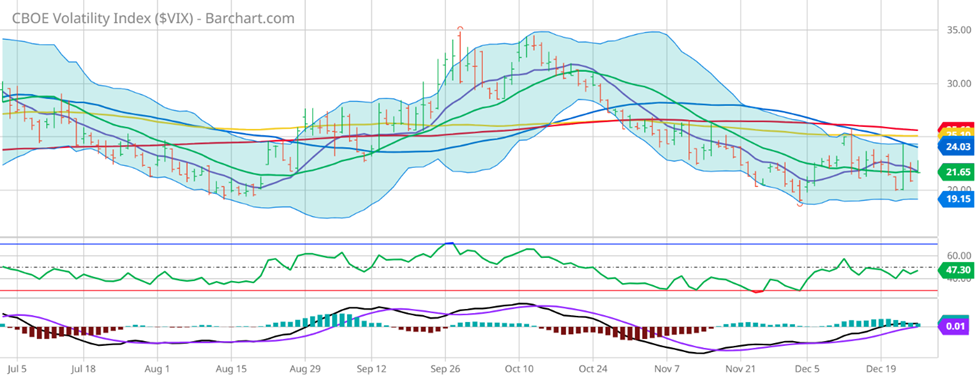

On top of this, the VIX is getting very low, which means options leverage is getting cheap. Additionally, this tends to mean that the market risk to the downside is low:

With these mixed signals, but the market at an inflection point, I’d say buying options while leverage is cheap is the only way to play this market! And as mentioned, there are many interesting names in this market for playing the potential rebound if the market has fallen too much that I discuss weekly in my Outlier Watch List!

So please go to http://optionhotline.com to review how I traditionally apply technical signals, volatility analysis, and probability analysis to my options trades. As always, if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments